Wage theft occurs when an employer does not properly pay hourly workers for the time they worked. This is a serious problem that affects countless workers. Victims of wage theft are often unaware that they're being underpaid or are afraid to speak up. Wage theft can occur in several ways, including: forcing employees to work off-the-clock, refusing to pay overtime, paying workers less than minimum wage, or refusing to pay workers the agreed wages.

Fortunately, healthcare workers don’t have to face this kind of injustice alone. Our wage theft attorneys, like partner John Fabry, have decades of experience helping workers recover their hard-earned wages.

Hospital Workers Successfully Prove Wage Theft

A group of healthcare providers recently asked a federal judge to find their employers, HealthTexas Provider Network (HTPN), a member of the Baylor Scott & White Health system, liable for violating the Fair Labor Standards Act (FLSA) by denying them overtime pay. Though HTPN claimed the employees were exempt from receiving overtime pay because they were salaried workers, the Court found that the evidence showed the employees were paid an hourly wage. Consequently, they were unfairly denied time-and-a-half compensation for the time they worked over 40 hours in a week.

Between April 2017 and October 2019, the healthcare providers were instructed by their managers to clock in and out of a timekeeping system. They were then paid by the hour according to the time they were clocked into the system. The Court found that because the workers logged their time in the system and were paid accordingly, it was improper for HTPN to classify them as being exempt from receiving overtime pay.

In essence, the Court found that HTPN had been cheating these workers out of their hard-earned wages. The Court noted that, when questioned under oath, HTPN managers testified that these workers were paid by the hour for the time they were clocked into the timekeeping system. Further, written communications informed these employees that they “will be paid for exactly the time they are clocked in at the hospital.”

Faced with all of this evidence, and despite HTPN’s denials, U.S. District Judge David C. Godbey determined that the workers “were not paid on a salary basis.” Ultimately, he ruled that HTPN improperly deducted overtime pay from the workers' wages–in violation of the FLSA.

How Do Employers Defend Themselves Against Wage Theft Claims?

The “window of corrections” is an affirmative defense that employers accused of improperly deducting pay from worker salaries can use to protect themselves. If the employer can prove that deductions were inadvertent or isolated, and promptly correct the improper deduction, they can retain their employees’ overtime-exempt status. In simple terms, this defense protects employers that paid their employees too little, only a few times or by mistake, and then promptly reimbursed the deductions.

However, this defense didn’t protect HTPN. First, the Court found that the improper deductions were not isolated incidents. The healthcare workers reported that their employers frequently subtracted pay from their salaries when they worked less than 40 hours a week. In fact, audit reports showed an average of 118 underpayments per employee and an average of $4,200 in pay reductions per employee. The Court found that “this case combines a large number of employees, an entire team of managers, a significant amount of wages, and an extended time period.” Accordingly, the Court concluded that the deductions in pay were not isolated.

The other reason that HTPN couldn’t use the window of corrections defense is that the deductions were not inadvertent. There was no mistake in making the deductions; rather, the employees were intentionally paid on an hourly basis.

“There was nothing inadvertent about defendants' requiring plaintiffs to clock in and clock out for every shift they worked … and there was nothing inadvertent about defendants paying plaintiffs an hourly rate based solely on the amount of time they worked,” the workers said. “These were all intentional actions by defendants.”

Our partner, John Fabry, joined attorney David Kern in representing the employees. Together, they ensured that these workers will get fair compensation for their work.

How Does the Fair Labor Standards Act Protect Employees from Wage Theft?

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, recordkeeping, and child labor standards. It affects part-time and full-time workers in the private sector and in local, state, and federal government. The FLSA serves as powerful legislation to ensure workers get the pay their employers owe them. If the employer violates the FLSA, the government and the employees can hold them accountable for their unlawful actions.

What does the FLSA say about overtime pay?

The FLSA clearly states that eligible employees must get extra pay for the time they work over 40 hours in one workweek. Additionally, the overtime pay must be no less than one and

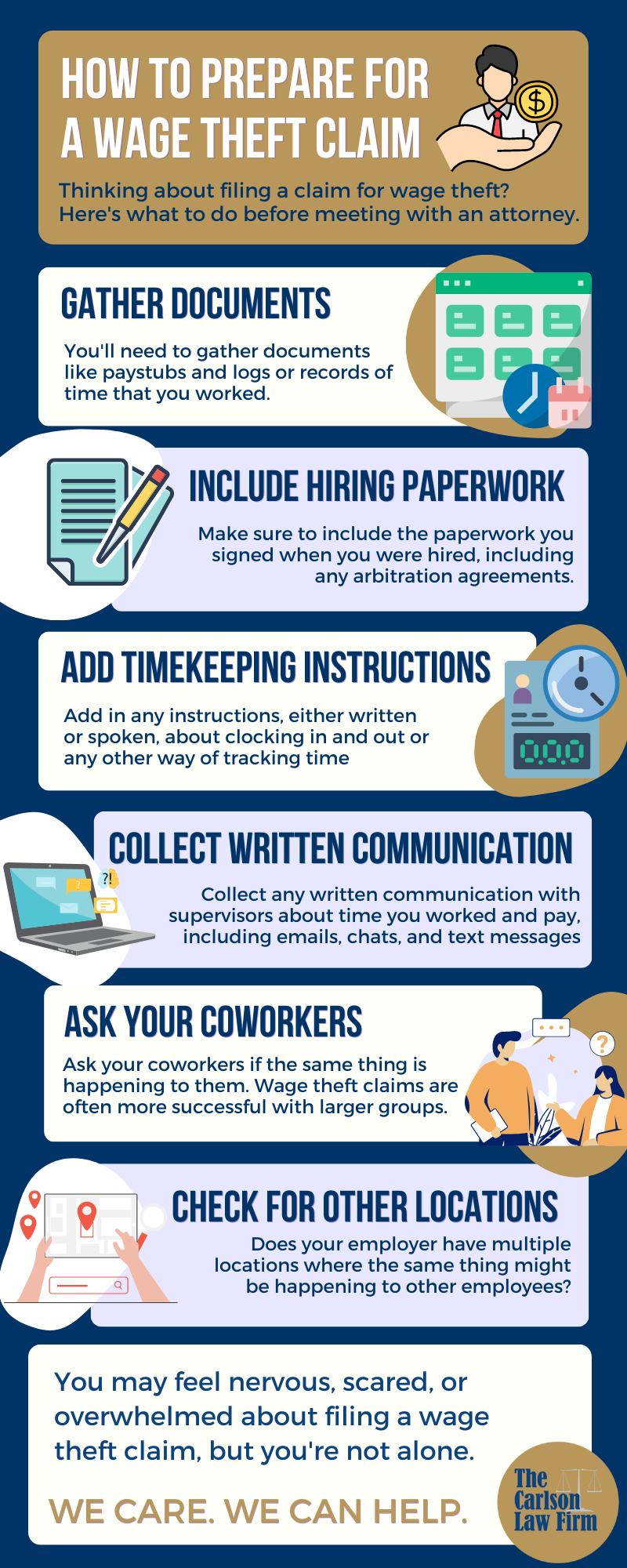

How to prepare for a wage theft claim

one-half their normal rate of pay. The government defines a workweek as 168 hours, or seven consecutive 24-hour periods. Employers cannot average the hours worked in two or more weeks. Rather, they must pay based on the hours worked in one week.

Who is eligible for overtime pay?

Each company’s Human Resource Office has the responsibility to determine whether each position is eligible for overtime pay. The eligibility is based on criteria set by the US Department of Labor. Generally, employees who work in executive, administrative, professional, and outside sales positions are not eligible for overtime pay if they make at least $684 per week.

How to Prepare for a Wage Theft Claim

Are you thinking about filing a claim for wage theft? If so, you need a caring and experienced attorney to help you get fair compensation. To help you win your case, your attorney will probably ask you to gather some evidence. Here’s what you can do to prepare for a wage theft claim.

- Gather documents. You’ll need to gather documents like paystubs and logs or records of the time that you worked.

- Include hiring paperwork. Make sure to include the paperwork you signed when you were hired, if it is available to you, including any arbitration agreements.

- Add timekeeping instructions. Add in any instructions from your employer, either written or spoken, about clocking in and out, as well as any other ways of tracking time.

- Collect written communication. Collect any written communication with supervisors about the time you worked and pay, including emails, chats, and text messages.

- Ask your coworkers. Ask your coworkers if the same thing is happening to them. Wage theft claims are often more successful with larger groups.

- Check for other locations. Does your employer have multiple locations where the same thing might be happening to other employees?

The Carlson Law Firm Can Help

We understand that filing a wage theft claim might be intimidating, but you don’t have to go through it alone. Our caring and compassionate legal team can walk you through the process step by step. If you need help with a wage theft claim, call an experienced and caring wage theft attorney today. We care, and we can help.